Successful Accounting & Finance Organizations in Technology Companies, Part 3 - Budget Management Processes

The role of Accounting and Finance organizations within technology companies has evolved in the past decade. As business models become more complex, investors, executives, and leaders increasingly turn to accounting and finance to help understand the past and advise for the future. In this dynamic environment, how do you set up your accounting and finance team to best steer your company?

In Part 1 and Part 2 of this blog series, we focused on organizational structure and planning and reporting cadences, respectively.

In our final post in this series, we’ll dive a little deeper on budget management processes and helpful tools. The four areas we will cover in this blog post include:

- Creating the budget

- Sharing the budget

- Operating against the budget

- Tools

Similar to our other posts, teams will want to modify these processes and tools depending on specific industries and sizes.

Creating the budget

The first part of creating an accurate budget is having a good handle on the current metrics and anything in flight. While the accounting system should have a set of financial actuals to use, it will be important to understand three additional things:

- What items in the current financials are not going to continue in the new period

- What items have been approved but are not reflected in financials yet

- What outstanding contracts exist, and the terms in those contracts. This is important to understand which cost items are or are not adjustable in future periods.

For all three points, ideally your company has a central repository to store contracts and purchase approvals, and it’s been kept up to date during the year. (If not, Sudozi can help!)

Getting into excel, the best place to start creating a budget is typically revenue. Understand how the company derives its revenue, quantify those processes and turn that into a few tabs in your budget workbook. After revenue is done, there are two primary ways to approach the cost of goods sold and expenses. The first is to use a percentage of revenue and the second is to extrapolate the current costs independently from revenue. Ultimately the budgeted amounts for each category will be a blend of the two methods with acknowledgement of any contractual changes discussed earlier. Do a quick check with department leads and vendor owners on these costs before locking in budgets.

For certain expenses, the finance team will want to take the budget one step further and be more prescriptive. Headcount is one area that consistently has more details in a company budget. Even within one department, headcount budgets can be broken down into different levels, job specifications, locations, and other details. Since payroll is typically one of the largest expense categories, the further drill down is needed so that HR teams and department leads know exactly what roles to hire for.

After the income statement (AKA P&L) budget is created, companies typically forecast cash implications and other items to obtain a balance sheet forecast.

Sharing the budget

It’s best to get alignment with the CEO before sharing any budgets. While it may seem innocent to share the company budget, there are parts of the budget that usually need to be communicated more carefully. For example, any revenue expectations will have embedded strategies and organizational implications. Questions could emerge such as: Which team is expected to generate more revenue? Which product is expected to shrink? Why is one region expected to have higher revenue than another one? On the expense side of the equation, vendor budgets and headcount budgets should be handled with care as it typically includes sensitive information.

Once there’s alignment with the CEO and executive team on who should see which budgets, finance is typically in the position to manually create different budget workbooks and any summary materials for the departments. Finally, while budgets can be shared digitally, it’s best to supplement that experience with a live meeting to communicate any important points or answer any questions. The finance team should manage the message associated with sharing the budget, and the best way to do that is to complement any budget sharing with communication.

Operating against the budget

After the budget is signed off and ready to go, now what? Going a step deeper than what we discussed in Part 2, it’s important to explicitly communicate expectations between finance and department leaders about when information should be transferred and why. As a finance team, evaluate what would impact the business the most. It could be a new vendor with a big cash outlay at the beginning, or an advertising purchase that didn’t fill the expected budget. Using those items that have the most meaningful business impact, clearly communicate 4-5 key things finance wants other departments to share.

The best finance leaders are open and communicative about why they need certain information and how that information impacts the company’s decisions. Department leaders want to do the right thing and are more motivated to comply with requests when they are bought into the process and understand the implications of not sharing the data. The most successful finance leaders are fantastic educators and relationship builders with their executive team peers. This allows finance teams to leverage their department leads to be regular stewards of the company’s limited resources.

At the end of each agreed-upon period, whether monthly or otherwise, the finance and accounting teams should prepare budget analysis and proposed forecast updates for department leads. This is an opportunity to reflect on what predictions were accurate and which ones weren’t, and therefore would need an updated forecast for the remainder of the year.

Establish with your business leaders the cadence for a full budget check in and review. It’s also helpful to be explicit about what each party will bring to the table in these reviews. Typically finance and accounting will bring financial actuals and forecasts, but department leads should also have responsibilities for these meetings. Typically they should be thoughtful about what their updated strategies are, and how those strategies may have implications on revenue or expenses.

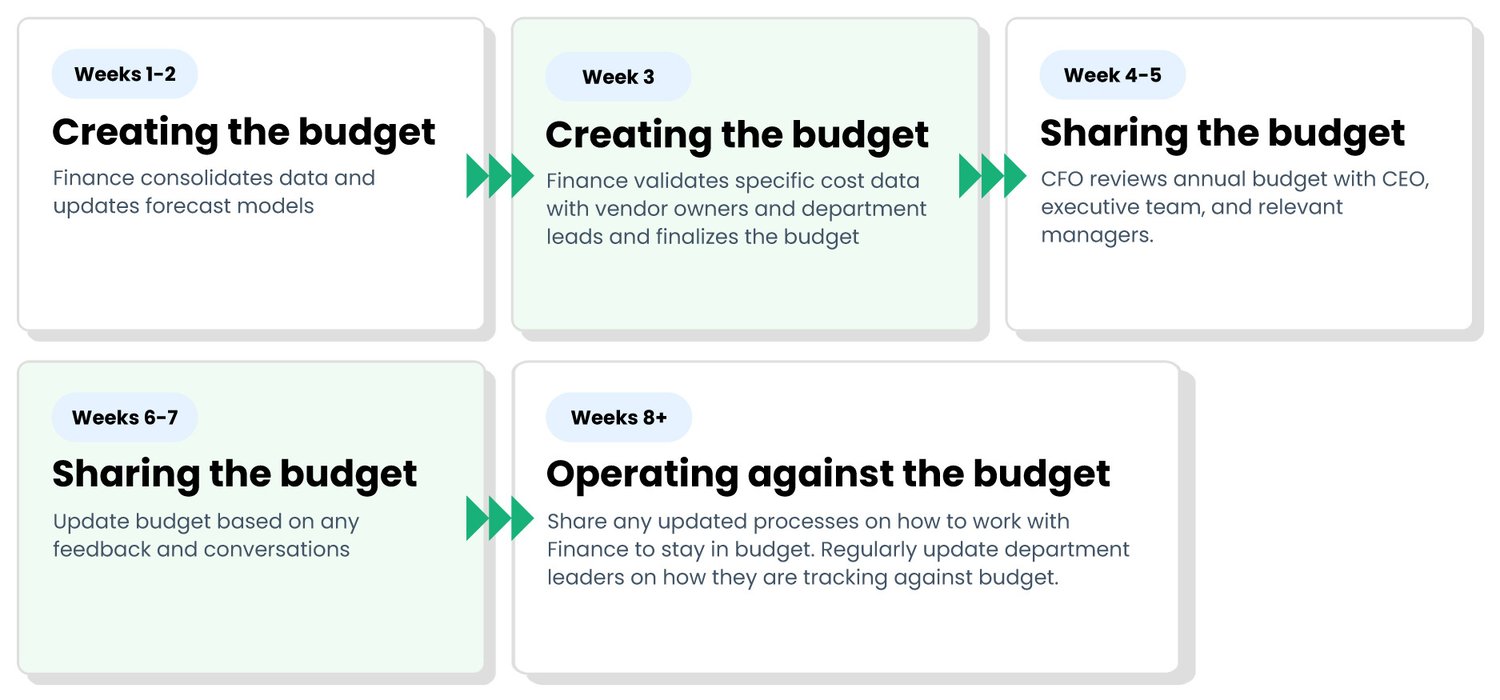

Here’s a quick sample calendar for managing a new budget:

Tools

Finally, something would be amiss in this post if we didn’t discuss the tools that can help teams make these processes more efficient. There are two types of tools that can help these processes: 1) ones that directly impact the budget process and 2) ones that manage workflows that feed into this process.

We’ll start with the latter and move to the former. Having a good set of financial operations tools (AP, corporate card, payroll, equity management) will expedite the availability and accuracy of cash flow data. In addition to finops tools, a good HRIS and ATS can streamline the data related to payroll, which is likely the largest area of expense for the company. Finally, the best companies digitize as much information about their customers and revenue as possible. Whether this is a popular CRM (Salesforce or hubspot as examples) or a home grown customer tool, having a tool to manage customers makes data availability and analysis more accessible for the finance teams.

Tools to directly facilitate the budget management process are becoming more popular and there are several tech-enabled newcomers. This makes sense - as the financial operations and accounting layer becomes more digitized, that enables the next layer of work, budgets, to become more digital as well. While there are many tools that exist, most teams are still relying on some form of Google Sheets, Excel, and document collaboration tools to complete the budget management processes.

For most companies, budget creation may remain in Google Sheets and Excel for some time due to the unique nature of business models and revenue creation. However, budget tracking and reporting are becoming easier to implement in a tool. Some key benefits of moving budget tracking to a tool include:

- Automated data consolidations: Easily aggregate digital data from multiple sources.

- Digital permissioning: Minimize the number of forked Google Sheets you have to create for each department. Grant everyone a unique login with customized permissions to the same dataset.

- Accelerate business insights: Evaluate BvA and other comparisons automatically. Focus the finance team’s energy on the variances that matter most.

Sudozi is building a comprehensive budget management system that will help you tackle these processes and get to insights faster. We would be excited to work with your finance and accounting teams to uplevel your budget processes!