Successful Accounting & Finance Organizations in Technology Companies, Part 1 - Team Structure

The role of Accounting and Finance organizations within technology companies has evolved in the past decade. As business models become more complex, investors, executives, and leaders increasingly turn to accounting and finance to help understand the past and advise for the future. In this dynamic environment, how do you set up your accounting and finance team to best steer your company? In this three-part blog series, we will share a summary of our recent session with Accounting & Financial Women’s Alliance on this topic.

To start off, you need to understand what type of business you’re running. While on the surface it may be easy to know if you’re a SaaS or consumer company, there are nuances that blur the line. For example, the recent trend of Product Led Growth has left many companies with operations that resemble both SaaS and consumer motions – spending marketing dollars for individuals to try the product but then running an enterprise sales cycle to generate more revenue. Don’t feel the pressure to fall exclusively into one type of business model, but know that if your business straddles different models, your org structure, processes, and metrics should reflect that combination.

We will start this blog series focusing on org structure. Setting up your accounting and finance organization is critical and will impact everything else.

Within the accounting and finance team there should be someone to run the combined department (maybe that’s you!). Whether that person’s title is CFO, VP, or Director will likely depend on the stage of the company and complexity of the business. After the leadership hire, the best teams are typically structured with one person running accounting and another running FP&A. The exact members of each team will again depend on your business model.

The accounting department will oversee creation of financial statements and manage finance operations (e.g., AP/AR, payroll, equity, and other matters that move money and assets). For companies with a sales team, you’ll likely have someone in accounting that oversees commission creation and payments, adding a layer of complexity to payroll. It’s not uncommon to have various parts of the accounting role outsourced even if there is an accounting lead in house.

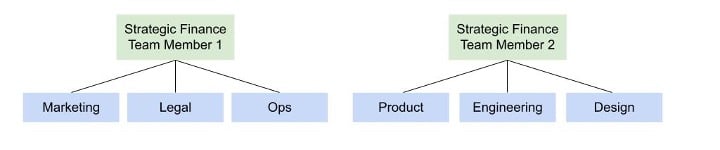

FP&A (or more recently, these teams have been called Strategic Finance), will create forecasts and budgets to help with future decisions at the company. Different business circumstances can lead to different specialties within Strategic Finance such as growth business partners (if the company is spending a lot of money on marketing and advertising), pricing (if the pricing levers at a company drive huge impact), technology business partners (if infrastructure or development costs are large), etc. It’s best practice to have all your main leaders at the company partner with a Strategic Finance team member so that there is a clear mapping on budget management and designated finance touch points across your organization. At a younger company, this may mean that there is one finance person who is the go-to individual for several executives. Your Strategic Finance team should be the connective tissue within the company, which will help build a holistic financial picture for the company. (See our example below with two Strategic Finance team members)

Within your Accounting & Finance team, it’s important to have strong relationships between teams, clear communication, and agreed upon timelines for regular processes such as month end close. To support the relationship between teams, it is recommended and common practice at younger companies that the members of both teams are present in the interviewing process for either team. Both teams need to work closely together to run these processes efficiently and disseminate information within the company to make decisions. Using tools like Sudozi can also help strengthen the relationship between Accounting & Finance teams by having a centralized platform to manage vendor information and spend requests for the entire company.

The Accounting & Finance org structure and the relationship within the org will have large impacts on the overall success of the team. We hope this blog post gives you a good overview of finance and accounting organizational structure. In future posts, we will take a deeper dive into processes and metrics for successful Accounting & Finance organizations in technology companies.